In the high-stakes world of real estate, agents and brokerages have long been fixated on ROI (Return on Investment). The formula was straightforward: spend money on leads, close deals, calculate the spread.

But a shift is underway. The most successful brokerages are moving from transaction-based models to production-centric cultures that prioritize a different metric: ROR, or Return on Relationship.

While ROI measures the immediate cash return on marketing spend, ROR measures the long-term value, loyalty, and ripple effects generated by investing in people. Here’s why shifting your focus from ROI to ROR may be the smartest economic decision you can make for your real estate business.

The Irrelevancy Gap: Where ROI Goes to Die

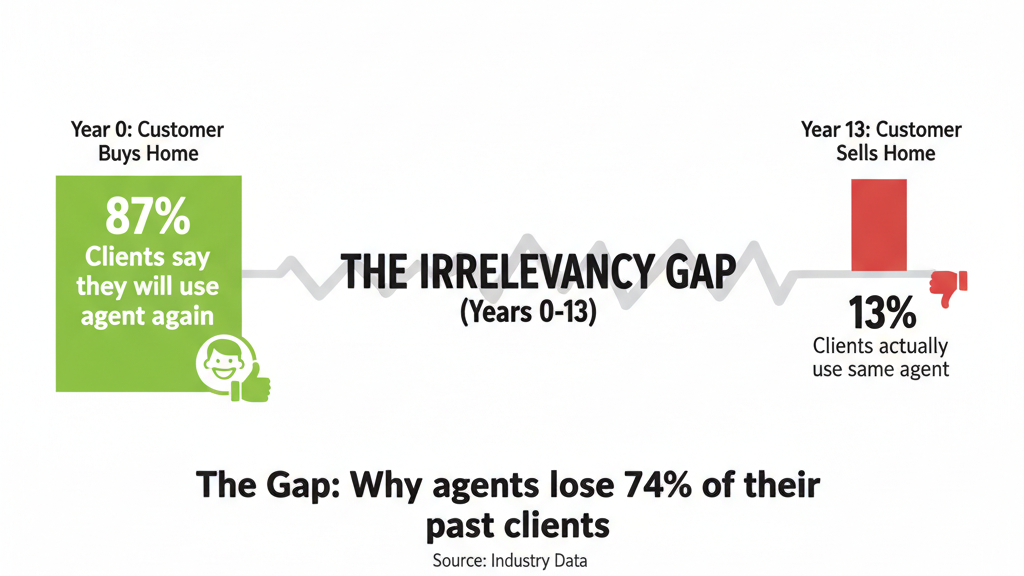

To understand why ROR matters, we first need to examine where the traditional model fails. There’s a massive disconnect in the industry—call it the “Irrelevancy Gap.”

Data shows that 87% of buyers say they’ll use their agent again immediately after a transaction. Yet only 13% actually do.

Why the drop-off? Because in the years between purchase and sale, the agent becomes irrelevant. They stop providing value, and the relationship generates no returns. By focusing only on the immediate ROI of the first deal, agents forfeit the compounding interest of the relationship.

The Math of Relationships: Why ROR Wins

When you run the numbers, the economics of relationship-building vastly outperform cold acquisition:

- Acquisition Cost: Acquiring a new client costs five times more than retaining an existing one.

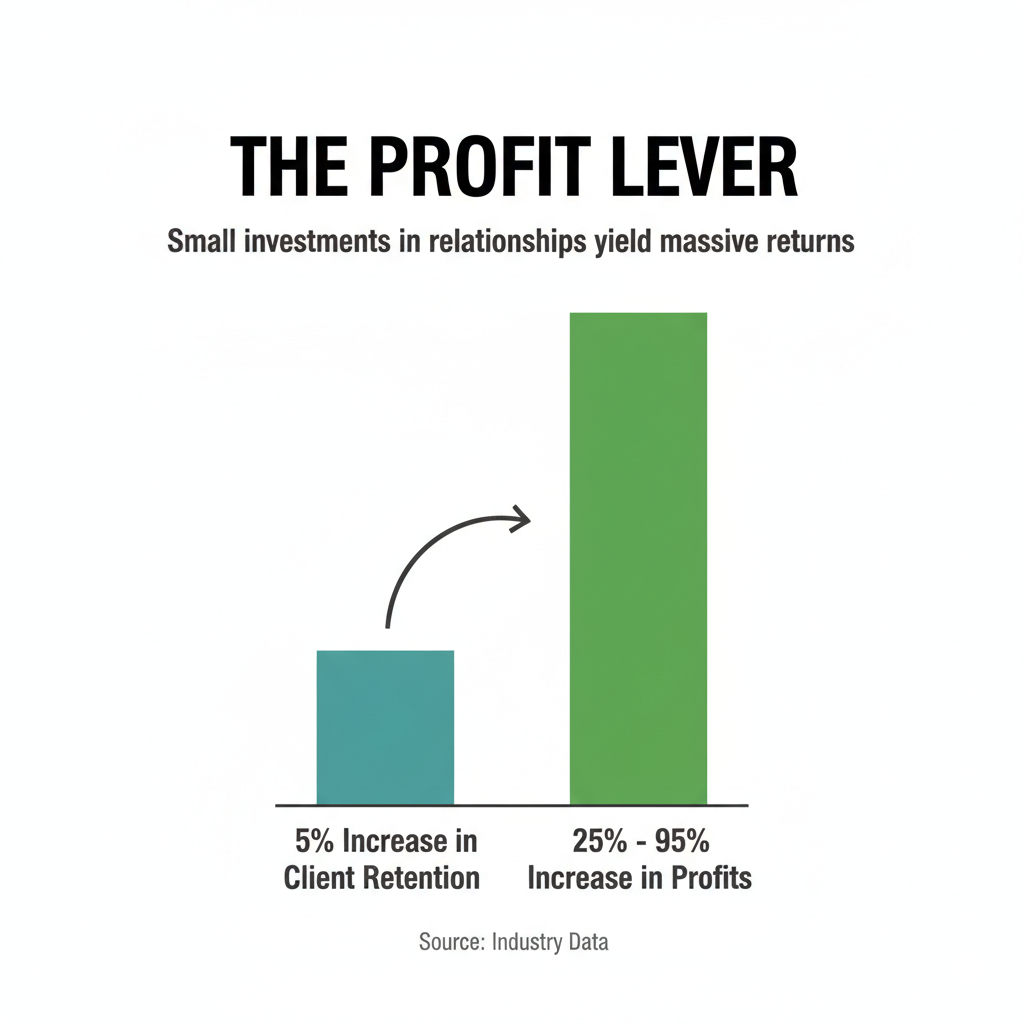

- Profit Leverage: You don’t need to double your client list to double your profits. Increasing client retention by just 5% can boost profits by 25–95%.

- Lifetime Value: Customers acquired through referrals aren’t just cheaper to get—they’re better customers. They stay 37% longer and deliver 16% more lifetime value than those acquired through paid advertising.

While ROI asks, “How much did I make on this deal?” ROR asks, “How much value will this person generate over their lifetime?”

Stop Selling, Start Serving

To generate high ROR, agents must shift their mindset from closing transactions to cultivating relationships.

Real estate professionals need to provide value beyond the deal itself. One of the most effective ways to do this is by becoming a connector. According to a 2025 NAR survey, providing a quality list of service providers—contractors, plumbers, inspectors—ranks as the #1 most valued agent benefit among buyers, even higher than price negotiation.

By curating a roster of vetted, trusted vendors, agents position themselves as the gatekeeper of quality service. This keeps them relevant during those gap years between transactions—and top of mind when referrals come up.

How to Operationalize ROR

You can’t build ROR with a spreadsheet or a mental Rolodex. You need a system that facilitates trust.

- Digitize Your Network: Move your vendor recommendations to a platform that allows you to share updated, branded lists with clients instantly.

- Mitigate Risk: “I know a guy” is a liability waiting to happen. Using a platform that verifies insurance and licenses protects your brokerage’s reputation and reduces exposure.

- Create a Growth Loop: Trust creates a flywheel. Referred customers are 30–57% more likely to refer new customers themselves, generating exponential growth.

Conclusion

In an industry where 82% of all transactions come from referrals, obsessing over the ROI of cold leads is a losing strategy. The new economics of real estate success depend on Return on Relationship.

By serving your clients long after the closing table—through trusted recommendations and vendor connections—you bridge the Irrelevancy Gap, retain the client, and unlock the true lifetime value of your business.